The news broke on Monday morning around 8AM before the capital markets open in North America. Pfeizer’s COVID vaccine proved to be over 90% effective in a final phase study.

Two other pharmaceutical companies followed the way, Monday morning, before market opening time, Moderna (NASDQ:MRNA) and AstraZeneca (LON:AZN), released the news of two other effective vaccines.

But what does that mean for Canadian markets, and specifically Toronto’s real estate market?

I, as a Toronto real estate agent, have been working, analysing, and contributing to articles and news outlets about Toronto’s real estate. In this article I will map out the possible outcomes in the short and long term for both Canada and Toronto’s Real Estate market. This is the most thorough article on the COVID-19 impact on Toronto’s real estate market.

There is another major factor that would have an impact on Toronto’s real estate market, which is the presidency of Joe Biden. I’ll explain that later on.

Is Toronto’s real estate market gonna crash or skyrocket? When will it be the bottom?

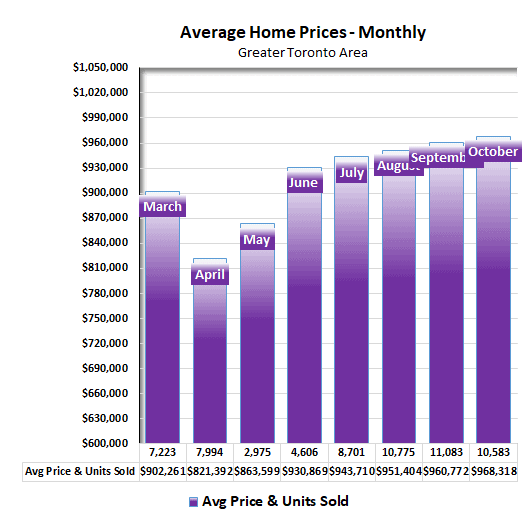

If you are a market enthusiast, whether it’s capital market or real estate, you know that timing is very important to get in or out of the market. Many analysts try to find the bottom using any tool they can find. In the real estate market, finding the bottom is a bit different.

Before looking at the data to figure out what would be the approx bottom, let’s go and check some facts.

What drives the value in Toronto’s Real Estate market?

There are 7 major factors that drive the real estate market and how the Vaccine might affect any of them. Pandemic for sure had an effect on Toronto’s real estate market, but the impact wasn’t the same all across the big city.

1.Cost of Ownership

Cost of ownership, undoubtedly, is the main driver in the real estate market. Mortgage rates are at their historically low right now, which made the borrowing cheap.

Before jumping to any conclusion regarding the cost of ownership in Canada we need to look at two indicators. The first one is the overnight lending rate set by the Bank of Canada. The second one is the Government of Canada’s marketable bond yield for 10years Government Bonds.

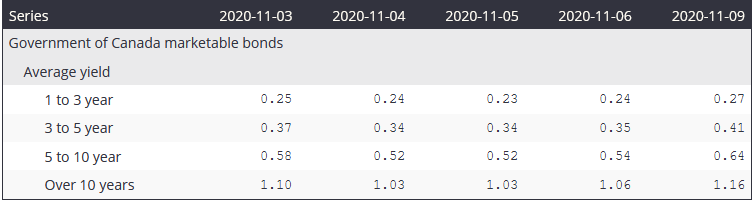

The latter jumped from 1.06% on Nov 6th to 1.16 on Nov 9th the same day that the Vaccine news broke.

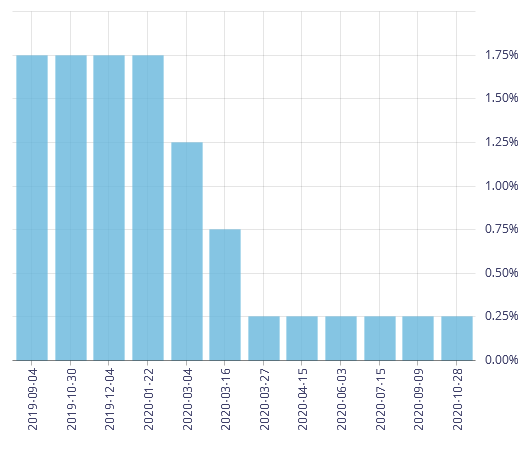

BoC Policy Interest Rate AKA “overnight” lending rate

Government of Canada’s Marketable Bond Average Yields

The jump in Government Canada’s 10 years yield, which jumped almost 9% in just one day on November 9th is a sign for future possible rate increases. The same bond rates were fluctuating just shy of 1% in September, now they are fluctuating around 1.1% ( 10% higher than a couple months ago ).

Now if you put all those pieces of the puzzle together what would you see? Not only the vaccine news is talking about an end to this pandemic market, but the 10years bond yield also tells a story. Of course it will take months or a year or more for the vaccines to reach the public, but the news of it has already pumped the markets.

The overall signal is that the rates are historically low and the money is cheap, but in the long term, signals show that the rates might go up a little. Thus the money most probably will remain cheap at least till the next recovery, but not forever!

Based on the signals that I follow, I doubt that it gets cheaper either ( zero or negative interest rates ). It still can go down, but chances seem very low. Wish I had a crystal ball to say for sure!

2.Jobs and Job Security

The second wave in Ontario caused Toronto and Peel regions to go to lockdown. This is the second COVID-19 lockdown in Ontario. The impact of the first lockdown was way worse than the second lockdown. In the first lockdown people, mostly from the service industry, were not prepared for it.

The first lockdown forced many businesses and corporations to adapt to new technologies and or working remotely. That caused many employees to vacate the offices and start working from home. Thus those industries that were prepared, are still thriving, but that’s not the case for all businesses.

The second lockdown mostly hurts the main street, such as restaurants, small businesses, mom and pops shops, some retailers, venues, etc.

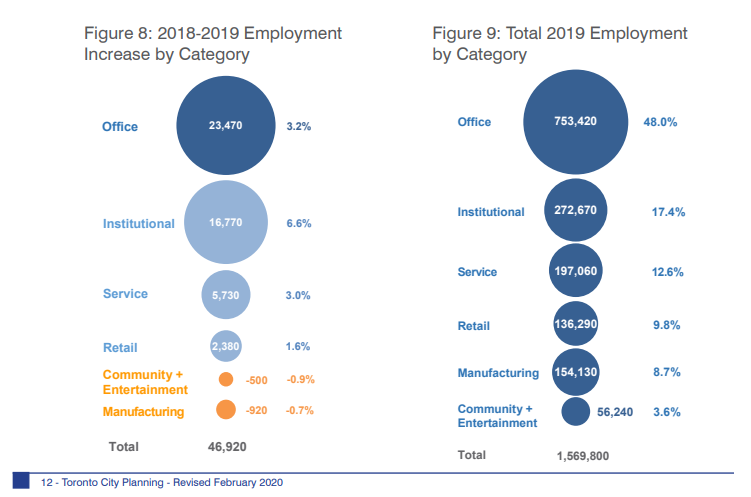

If we look at Toronto’s Labour Force Demographic, we’ll notice a few facts about the job market. The majority of the employment in Toronto is being driven by the below categories, such as Office, institutional and service.

Retail and entertainment are less than 14%. And unfortunately two latter ones are the ones that hit the hardest by the lockdowns. Of course there might be sub categories of office or service that got impacted by the lockdowns.

Other impacts could be less working hours, no overtime pay, etc. Although the main street got hurt by the lockdown, the majority of the jobs in Toronto can still survive during the pandemic. In addition to that, Toronto has a lively technology sector, which adds more and more tech jobs every year.

3.Population Growth

By taking a look at the migration and immigration data, we’d realize that the Greater Toronto Area has always been a popular destination. Toronto is the financial capital of Canada, and Canada’s largest city.

Prior to the pandemic, in 2019 approximately 118,000 immigrants moved to Toronto. That is approximately 35% of the total immigrants. The immigration programs slowed down because of the pandemic in 2020.

However on October 30th, the government of Canada announced new immigration plans for the next three years. The plan is to add approximately over 400,000 permanent residents each year. Which roughly 35% of immigrants might possibly move to the greater Toronto area.

With the COVID19 under control and safety measures and possible cure or vaccine, the immigration rate looks pretty steady. So if you add the migration to that number as well, you’d see Toronto’s population is on the rise. That’s a major factor in the real estate market.

People will always need a roof over their heads, so they have to rent or buy. If they rent, they will fill the vacant units. If they buy, they will take the inventories off the market.

In many ways, Toronto’s real estate market would keep moving forward because of population growth.

Wanna know where the real estate is headed? Follow the population. Humans are smart entities, they will follow opportunities. Whether it’s quality of life, or jobs, or other opportunities, people will follow those.

4.Supply

If you look at the market right now, specifically some markets that seem saturated, you might wonder that we have too much supply. To open this part for you I’ll discuss two types of property classes. A. Freehold B. Condos

A.Freehold

The Freehold market in Toronto, even during the pandemic, has been a sellers market. If we look at the historic data we see that in the past 5 months, the inventory level in the freehold Detached market has been fluctuating between 1.6 to 1.3 Month of Inventory. If you are not familiar with this term, you can follow my Youtube channel for more information.

Anything under approx 2.5 Month of Inventory is considered a seller’s market. 2.5 to 4 MOI is considered a balanced market, and above 4 is considered a buyer’s market.

Sold data shows that Toronto’s Freehold ( detached, semi-detached and Townhomes) have been in a seller’s market category. Interestingly Semi-Detached homes have had the tightest inventory level of average 0.8 MOI in the past 5 months.

B.Condo

The Condo Market on the other hand was hurting, mainly in Downtown Toronto. If you have been following my videos on social you know that I have been discussing the major drivers of the Downtown Toronto’s condo market.

The average inventory level in Toronto’s overall condo market in the past 5 months was 3 MoI. That’s a balanced market by the way.

But Downtown Toronto’s average month of inventory has been over 4 MoI. Past month it was 5.4 MoI, which is a buyer’s market.

Lack of tourists kept many Airbnb and short term rentals vacant and pushed them to add to the long term rental supply. Therefore the vacancy rate went up, and for rent and for sale inventory in Downtown increased.

Other factors such as students, immigrants and office employees have also played a role in worsening the vacancy rated in Downtown.

The vaccine or a possible cure for COVID19 would help the government and health authorities to ease the restrictions. In that case more businesses will open. And immigrants, international students, office workers, and tourists will come back to our beloved city.

When that happens we’d see that the supply in some areas such as downtown, even though it may seem plenty at the moment, will not be enough.

When the demand that’s waiting outside, comes back to the Downtown market, we’ll see how fast the supply will dry out. That’s when the real estate market is going to move up, as fast as it moved down.

5.Regulatory Changes

Major regulatory changes would come into place after the COVID19 gets more under control. Whether it’s a vaccine or a cure or any sort of medicine etc. But till then I don’t see the government make any major regulatory changes.

Opening up the borders, the city, and businesses, can reverse the impact of COVID19 on the economy and on Toronto’s real estate market. Entertainment and nightlife are amongst the major attractions in the big city.

When more tourists start to visit Toronto, many of short term rentals that flooded the long term rental inventory, would be taken away.

When international students and office workers come back to downtown core, the rental inventory would shrink again. Thus the low vacancy rates would attract more investors to buy in Toronto’s condo market.

The result would be that the real estate market in impacted areas would bounce back in a short period of time.

6.Global Factors

Other than COVID19, global factors that affect Toronto’s real estate market can vary significantly, from Trade deals to U.S. Presidency to Oil prices.

So far we have reviewed different aspects of COVID’s effect on Toronto’s real estate. Now it’s time to review the second major global factor. U.S. Presidency of Joe Biden.

At this point that I’m writing this article, Joe Biden is the president elect of the United States. But in order for democrats to have full control, they must have the Senate and the House by their side. It’s hard to say that the Senate would be a Democrat majority. So I base my analysis on a Republican majority Senate.

Joe Biden’s policy in major Global issues, such as climate change, COVID will affect Canadian’s economy as well. Why? Because they are our biggest trade partners!

Some of those policies require fundings, and I still see the possibility of more stimulus packages from the Fed and US Government. The result of that would be more money into the capital markets. Resulting in possible inflation in commodities and or real estate.

A part of that money will eventually enter the Canadian economy. So that will be another factor which can drive the price tags up in Toronto’s real estate market in the future.

7.Replacement Value vs. Market Value

This one is a factor that drives the resale market. If you purchase a new home, or a pre-constructions, you know that the price is higher than its equivalent resale.

The reason is that the buildings or houses that have been built 10 years ago for example, were built with cheaper construction costs and built on the lands that were bought cheaper.

In today’s market, if a builder wants to build the very same house, the premiums that the builder has to pay are much higher. The land is more expensive, levies and development charges are higher, and construction costs are more than what they were 10 years ago.

That’s why when you look at the resale condo or detached market, you’d see prices are cheaper than a new pre-constructions sale that would be ready 4 or 5 years down the road.

I’ll give you an example of only 1 item, lumber. According to a Global news report builders mention that the lumber price increase can translate anywhere between $8,000 to $10,000 more cost in building a single family home.

And remember, that Lumber is only one item, if you break down a building’s cost you can narrow it down to tens of construction items. Then you add the development charges and many other fees. Plus, the builders have to buy land with inflated prices to build houses on.

Thus the gap between the Replacement value and Market value, would push a part of purchasing power to the resale market. That demand will absorb some of the resale housing instead of investing in the future housing.

In the short term, an average consumer might not feel the difference. But in the long term, when the population grows in 5 or 10 years from now, we will have a lack of supply in the housing market. That will also put pressure on the future housing in Toronto’s real estate market.

Conclusion:

If you go through the ll 7 factors that I analysed above, you already know that Toronto’s real estate market is healthy compared to many other parts of Canada or the world.

Detached and Freehold houses have been in high demand even during the COVID. Condos though fell behind the freehold because of what I discussed above. But once the gap between Freeholds and Condos gets too big, a part of the demand will get back to the condo market.

Those who get priced out of the freehold market will get to the condo market. However the major change will happen when the businesses and the city opens up. That might happen shortly after the COVID gets relatively under control.

Please add SHARE BUTTONS here

- FIND A TOP REAL ESTATE AGENT FROM ONE OF TORONTO’s TOP BROKERAGES

We’ll match you with a Top Real Estate Agent from One of the Top Brokerages. Submit the request here in a few seconds.

![RLPS Logo-V [1Col RGB]-01 RLPS Logo-V [1Col RGB]-01](https://armanigroup.ca/wp-content/uploads/elementor/thumbs/RLPS-Logo-V-1Col-RGB-01-ohdkdw2fqtxwk9umk2c95d4sl5au0r49wgcs41fj7k.png)